All Categories

Featured

Table of Contents

- – Comprehensive Accredited Investor Investment N...

- – Renowned Accredited Investor Crowdfunding Oppo...

- – Comprehensive Accredited Investor Funding Opp...

- – Exclusive Investment Platforms For Accredited...

- – Advanced Exclusive Deals For Accredited Inve...

- – Specialist Accredited Investor Passive Incom...

It's important to comprehend that attaining certified investor condition is not an one-time achievement. It's for that reason essential for recognized financiers to be proactive in monitoring their financial circumstance and upgrading their records as required.

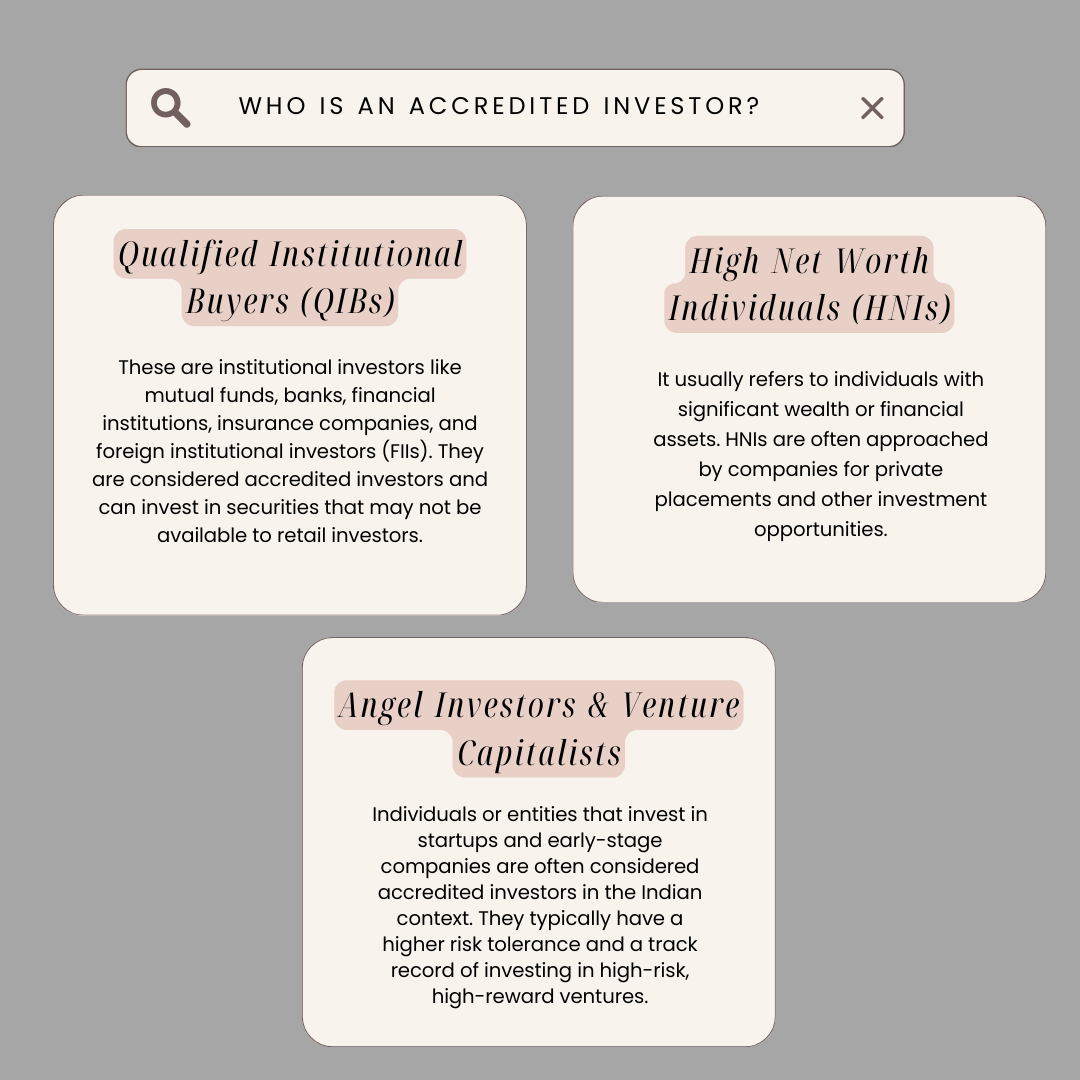

Failing to meet the ongoing standards may lead to the loss of recognized financier status and the associated privileges and possibilities. While a lot of the financial investment types for Accredited Financiers coincide as those for any person else, the specifics of these investments are typically different. Personal positionings describe the sale of safety and securities to a select group of recognized capitalists, generally beyond the public market.

Private equity funds swimming pool funding from recognized capitalists to obtain ownership stakes in firms, with the goal of enhancing efficiency and creating considerable returns upon exit, normally with a sale or first public offering (IPO).

Market fluctuations, residential property management challenges, and the possible illiquidity of property properties should be very carefully examined. The Securities and Exchange Compensation (SEC) plays an essential duty in regulating the activities of certified financiers, who should comply with specifically described policies and coverage demands. The SEC is in charge of imposing safeties legislations and regulations to secure investors and preserve the honesty of the monetary markets.

Comprehensive Accredited Investor Investment Networks

Regulation D gives exemptions from the registration demands for specific private placements and offerings. Accredited financiers can take part in these excluded offerings, which are normally expanded to a limited variety of innovative investors. To do so, they need to supply accurate information to issuers, full required filings, and follow by the policies that control the offering.

Conformity with AML and KYC needs is important to maintain standing and get to different financial investment possibilities. Stopping working to follow these guidelines can result in extreme fines, reputational damage, and the loss of accreditation advantages. Allow's unmask some typical misconceptions: An usual false impression is that recognized financiers have a guaranteed benefit in regards to financial investment returns.

Renowned Accredited Investor Crowdfunding Opportunities

Yes, recognized financiers can lose their standing if they no more meet the eligibility criteria. For example, if an approved financier's income or web well worth falls below the marked limits, they may lose their certification - accredited investor wealth-building opportunities. It's important for certified capitalists to regularly assess their financial situation and report any type of modifications to make sure conformity with the laws

It depends on the specific financial investment offering and the policies regulating it. Some financial investment possibilities might permit non-accredited capitalists to get involved via particular exemptions or stipulations. It is essential for non-accredited financiers to meticulously evaluate the conditions of each financial investment chance to determine their eligibility. Bear in mind, being an accredited investor includes benefits and duties.

Comprehensive Accredited Investor Funding Opportunities

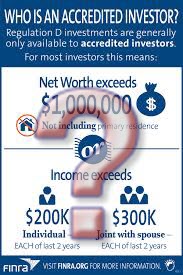

If you wish to invest in certain complicated financial investments, the Securities and Exchange Commission (SEC) requires that you be an accredited capitalist. To be recognized, you need to satisfy specific demands concerning your riches and income along with your financial investment knowledge. Take an appearance at the basic demands and advantages of ending up being a certified investor.

The SEC thinks about that, because of their monetary stability and/or investment experience, certified financiers have much less requirement for the protection offered by the disclosures called for of managed financial investments. The policies for certification, which have actually been in location given that the Stocks Act of 1933 was developed as a response to the Great Depression, can be located in Policy D, Regulation 501 of that Act.

Exclusive Investment Platforms For Accredited Investors

However, that company can't have been developed simply to purchase the unregistered safety and securities in question. These requirements of income, web worth, or specialist experience make certain that inexperienced financiers don't run the risk of money they can not manage to lose and don't take financial threats with investments they don't recognize. No actual certification is readily available to confirm your status as a recognized investor.

When you seek recognized investor standing, you're likely to go through a screening process. Documents you will possibly have to produce may consist of: W-2s, tax obligation returns, and various other papers verifying incomes over the previous 2 years Financial statements and bank statements to verify web worth Credit rating records Documents that you hold a FINRA Series 7, 64 or 82 designation Documentation that you are a "well-informed staff member" of the entity providing the safety and securities The capacity to invest as a "knowledgeable employee" of a fund releasing safeties or as an economic specialist holding a suitable FINRA license is new as of 2020, when the SEC increased its definition of and certifications for recognized capitalists.

Advanced Exclusive Deals For Accredited Investors

These safeties are unregistered and uncontrolled, so they do not have readily available the regulative defenses of licensed protections. In basic, these financial investments might be especially volatile or lug with them the potential for considerable losses. They include numerous organized financial investments, hedge fund financial investments, exclusive equity financial investments, and various other personal positionings, every one of which are unregulated and may lug significant threat.

Certainly, these investments are also appealing due to the fact that in enhancement to added danger, they lug with them the potential for significant gains, generally greater than those available via regular investments. Certified capitalists have readily available to them investments that aren't open up to the general public. These investments consist of personal equity funds, angel financial investments, specialized financial investments such as in hedge funds, equity crowdfunding, property mutual fund, venture resources financial investments, and straight investments in oil and gas.

Companies using unregistered safeties only have to offer documents concerning the offering itself plus the area and policemans of the company providing the safety and securities (accredited investor platforms). No application procedure is needed (as is the situation with public stock, bonds, and common funds), and any due diligence or added info provided depends on the company

Specialist Accredited Investor Passive Income Programs

This info is not meant to be individual guidance. Possible individuals need to speak with their personal tax specialist pertaining to the applicability and impact of any type of and all benefits for their own individual tax situation. Additionally, tax regulations change from time to time and there is no guarantee regarding the analysis of any type of tax obligation legislations.

Recognized financiers (in some cases called professional financiers) have accessibility to financial investments that aren't offered to the general public. These financial investments might be hedge funds, tough cash financings, exchangeable investments, or any kind of various other protection that isn't signed up with the monetary authorities. In this write-up, we're mosting likely to focus specifically on property investment choices for accredited capitalists.

Table of Contents

- – Comprehensive Accredited Investor Investment N...

- – Renowned Accredited Investor Crowdfunding Oppo...

- – Comprehensive Accredited Investor Funding Opp...

- – Exclusive Investment Platforms For Accredited...

- – Advanced Exclusive Deals For Accredited Inve...

- – Specialist Accredited Investor Passive Incom...

Latest Posts

Delinquent Tax Payments

Secrets Of Tax Lien Investing

Tax Liens Investing Risks

More

Latest Posts

Delinquent Tax Payments

Secrets Of Tax Lien Investing

Tax Liens Investing Risks