All Categories

Featured

Table of Contents

As recognized financiers, individuals or entities may take part in exclusive investments that are not signed up with the SEC. These capitalists are assumed to have the monetary elegance and experience needed to assess and buy risky financial investment opportunities inaccessible to non-accredited retail capitalists. Below are a few to take into consideration. In April 2023, Congressman Mike Flooding presented H.R.

In the meantime, investors must comply with the term's existing interpretation. Although there is no official procedure or federal certification to come to be a recognized capitalist, a person might self-certify as an approved financier under existing laws if they gained greater than $200,000 (or $300,000 with a spouse) in each of the previous 2 years and anticipate the exact same for the present year.

People with an active Series 7, 65, or 82 license are also thought about to be accredited investors. accredited investor funding opportunities. Entities such as corporations, partnerships, and trust funds can also achieve recognized financier standing if their financial investments are valued at over $5 million.

Preferred Accredited Investor Funding Opportunities with Accredited Investor Returns

Right here are a couple of to consider. Private Equity (PE) funds have actually shown exceptional growth in current years, apparently undeterred by macroeconomic obstacles. In the third quarter of 2023, PE deal volume surpassed $100 billion, approximately on the same level with offer task in Q3 of the previous. PE companies pool funding from accredited and institutional capitalists to obtain controlling interests in fully grown personal firms.

In enhancement to capital, angel financiers bring their specialist networks, support, and expertise to the startups they back, with the assumption of venture capital-like returns if the company takes off. According to the Center for Endeavor Research study, the typical angel investment quantity in 2022 was about $350,000, with financiers receiving a typical equity risk of over 9%.

That stated, the advent of on-line personal credit score systems and niche enrollers has made the asset course obtainable to private recognized capitalists. Today, financiers with as little as $500 to spend can capitalize on asset-based personal credit scores possibilities, which supply IRRs of up to 12%. In spite of the rise of shopping, physical grocery stores still make up over 80% of grocery sales in the United States, making themand particularly the property they run out oflucrative investments for recognized capitalists.

Superior Private Placements For Accredited Investors

In contrast, unanchored strip centers and area facilities, the next two most greatly negotiated kinds of realty, videotaped $2.6 billion and $1.7 billion in purchases, respectively, over the exact same duration. What are grocery store-anchored? Suburban strip malls, outlet malls, and other retail centers that feature a major supermarket as the location's major renter generally fall under this group, although malls with enclosed walkways do not.

Approved financiers can spend in these areas by partnering with genuine estate exclusive equity (REPE) funds. Minimum investments normally begin at $50,000, while total (levered) returns vary from 12% to 18%.

The market for art is also increasing. By the end of the decade, this figure is anticipated to approach $100 billion.

Accredited Investor Passive Income Programs

Investors can currently have diversified exclusive art funds or purchase art on a fractional basis. These alternatives come with financial investment minimums of $10,000 and provide net annualized returns of over 12%.

(SEC).

The requirements of who can and that can not be a certified investorand can take part in these opportunitiesare determined by the SEC. There is a common false impression that a "process" exists for a private to come to be a recognized investor.

Elite Accredited Investor Alternative Asset Investments

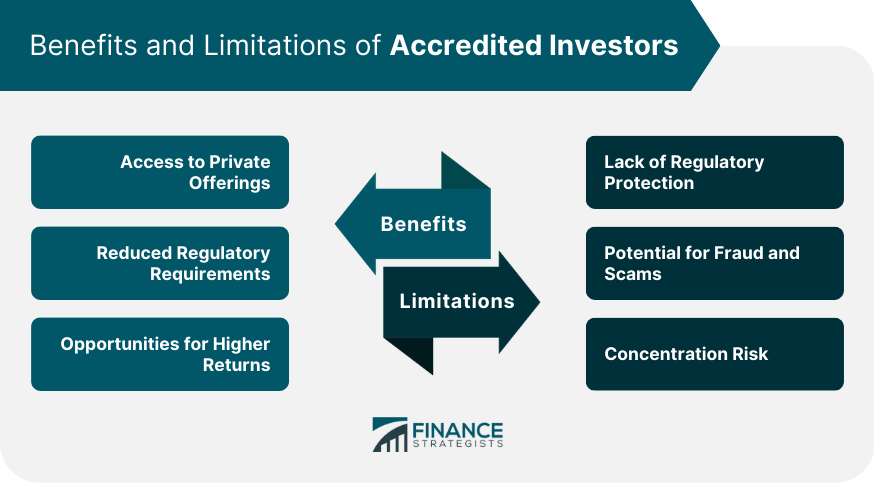

The burden of showing an individual is a recognized investor falls on the financial investment lorry as opposed to the capitalist. Pros of being a recognized investor include accessibility to one-of-a-kind and limited financial investments, high returns, and increased diversity. Cons of being a recognized investor consist of high threat, high minimum investment amounts, high costs, and illiquidity of the investments.

Regulation 501 of Law D of the Stocks Act of 1933 (Reg. D) gives the interpretation for an approved financier. Put simply, the SEC specifies a certified investor with the confines of earnings and total assets in two means: A natural individual with income surpassing $200,000 in each of both newest years or joint income with a partner exceeding $300,000 for those years and a reasonable expectation of the very same earnings degree in the present year.

Roughly 14.8% of American Households certified as Accredited Investors, and those houses controlled roughly $109.5 trillion in wide range in 2023. Determined by the SCF, that was around 78.7% of all exclusive wide range in America. Rule 501 additionally has provisions for corporations, collaborations, philanthropic organizations, and rely on addition to business directors, equity proprietors, and monetary establishments.

Accredited Investor Funding Opportunities

The SEC can add certifications and designations going onward to be consisted of in addition to encouraging the general public to send propositions for various other certificates, classifications, or credentials to be considered. accredited investor opportunities. Staff members who are thought about "knowledgeable workers" of a personal fund are now also thought about to be certified capitalists in relation to that fund

Individuals who base their certifications on yearly income will likely need to send income tax return, W-2 types, and various other documents that suggest incomes. Individuals might additionally take into consideration letters from testimonials by CPAs, tax attorneys, financial investment brokers, or consultants. Approved financier classifications additionally exist in other nations and have comparable needs.

In the EU and Norway, as an example, there are three examinations to determine if an individual is a certified financier. The first is a qualitative test, an examination of the person's knowledge, knowledge, and experience to figure out that they are capable of making their own investment decisions. The 2nd is a measurable test where the person has to fulfill two of the complying with requirements: Has lugged out deals of significant size on the pertinent market at an average regularity of 10 per quarter over the previous 4 quartersHas a financial profile going beyond EUR 500,000 Functions or has operated in the monetary industry for a minimum of one year Last but not least, the customer has to state in written kind that they intend to be treated as a specialist client and the company they want to work with must give notification of the protections they could lose.

Table of Contents

Latest Posts

Delinquent Tax Payments

Secrets Of Tax Lien Investing

Tax Liens Investing Risks

More

Latest Posts

Delinquent Tax Payments

Secrets Of Tax Lien Investing

Tax Liens Investing Risks